The rise of mobile payment technology or payment apps is one of the biggest Fintech trends to impact the brick-and-mortar business in the last few years. The Global M-Commerce revenue is forecasted to reach $3.56 trillion in 2021. 79% of smartphone users have purchased online using their mobile devices in the last six months.

In North America alone, 29.3% of people use digital or mobile wallets for their e-commerce transactions. The most consumed payment apps globally are Apple Pay, Cash App, Google Pay, Chase Pay, Samsung Pay, etc. With such an increase in demand, consumption, and engagement of users with these apps, it’s likely to witness many more such apps in the future.

In this blog, we shall now move to understand what retention rate means and its significance in the case of payment apps.

Understanding the retention rate for Payment Apps:

The retention rate of an app is best understood by the percentage of users who use your app after a set period after installation, for instance, a day, three days, and so forth. The more days, the better retention. There is a huge rise in demand for the contactless and easy mode of payments for products and services. Digital payment app transactions are gaining huge popularity as more users are using them. A significant portion of smartphone users has transformed their mode of payments from physical to digital. Mobile payments allow customers and vendors to carry all the payment tasks like paying bills, booking tickets, or transferring money. As per statistics, a rise of 5% in customer retention increases your profitability by 95%.

Let’s look at some of the challenges these payment apps face while trying to grow.

The Problem of Retention Rate

Ensuring that people are consistently using your payment app can be a challenge but is extremely critical. According to statistics, the number of new users acquired on Day 1 of your app is projected at 91%, and as time passes, it dips 31% on Day 7. On average, a mobile payment app or any other app for that matter may expect to retain only about 7.5% of its users beyond the first month of usage.

Best Practices to Increase Your User Retention

Brands are using multiple ways to enhance their retention rate and engagement through their payment apps. Let’s take the case of Starbucks to understand these practices that brands should adopt. Starbucks encourages and makes its payments via a dedicated mobile app. The app is beating off Apple and Android Pay competition, with 23.4 million users purchasing from it regularly. Customers love gaining points and becoming more familiar with the app, and love ordering from it.

Now, let’s move on to some of the best practices you can adopt for increasing your mobile app retention rate.

a. Optimize your payment apps onboarding flow

A mobile app onboarding experience can be classified into three categories:

Benefit-oriented onboarding focuses on the value that the user gets out of a mobile app. It is best to showcase what the mobile app can do for the user in a few slides with clear language. On the other hand, function-oriented onboarding is used if your mobile app has a large number of features for your users to learn. Progressive onboarding shows your mobile app users the features in a particular sequence. If your mobile app has complex functionality, this type of onboarding is the best.

The major aspect to remember here is that it’s all about users’ psychology. If you give your users that feeling of accomplishment with your mobile payment app, you can ensure they come back.

b. Increase Personalized Experiences

Another way to enhance your mobile payment app retention is to customize your mobile app experience for the user. Personalizing the user journey in the app helps differentiate your mobile payment app from its competitors. It also helps to boost your mobile app’s loyalty.

The more you know about your user’s personas, the easier it is to personalize their actions and experiences. These can be done in both static and dynamic ways.

Static personalization uses factors that don’t change quite often. It could be as easy as including your user’s names in the notifications. Dynamic personalization – more focused on behavioral factors. One of the straightforward examples here is the customer’s purchase history.

c. Use Gamification to enhance engagement.

According to statistics, a mobile game retains 36% of its customers after the first week. You don’t need to have a detailed or extensive game to take advantage of these findings. It’s highly common to use game-like features in mobile payment apps.

Game-like features make your mobile app seem fun and rewarding. Most often, these are incentives or game points, like accumulating points for taking certain actions.

d. Implement push notifications

Push notifications can help you understand your customer behavior by noticing the time they interact with the app, their preferences, and most importantly, their favorite app functionalities. This can help marketers and developers to know more about the customers, and hence aid in personalized marketing again. According to statistics, push notifications, if used right, can enhance your mobile app retention rate by 10x.

Enhancing the retention rate through push notifications would require you to follow these major aspects:

- Pick the right time for push notifications.

- Customize notifications based on each user.

- Don’t overdo it.

e. Use In-app Messages

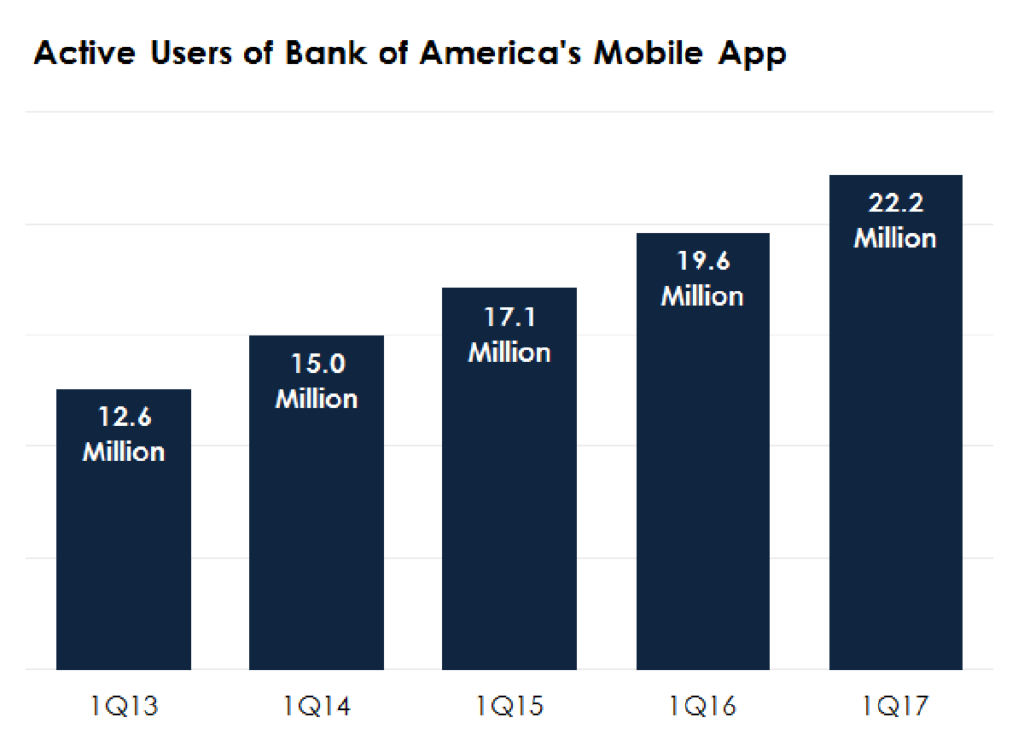

Research uncovers that companies using in-app messaging could enhance their user retention by 3.5 times as opposed to those who didn’t use it. Let’s understand this through an example of a famous banking app- Bank of America. It regularly sends its users in-app messages about updates on its policies, alerts for any important transactions, and other important messages that are relevant to the user. These messages help build an unsaid trust relationship between the user and the Financial institution.

f. Offer perks to loyal/engaged users

Offering perks to your engaged users is a way to create loyal followers. Creating loyal followers will help you get more recommendations for your mobile app. One such example is from Paypal which transformed its business model to focus on its loyal customers – and became one of the most used payment apps globally. It would interest you to know that it was earlier termed as one of the worst business models of the decade. However, with the changing consumer behavior and business policies, PayPal picked up.

The digital payment app industry is rising, and the competition is getting tougher by the day. It becomes imperative for the organization to analyze its users’ needs, focus on them, and then develop a customer-centric mobile app. We are one of the best mobile app development companies in Dallas. At Copper Mobile, we understand the customer’s demands and business challenges to render you a state-of-the-art solution for your mobile payment apps.